The damage caused by wind storms to your roof may be serious and insidious, and your house may be exposed to leaks, structural problems, and expensive repairs. The biggest step that the homeowners can take in order to recover their finances following a terrible weather is filing a wind storm roof damage insurance claim. Unluckily, some of the claims are postponed, rejected, or undercompensated just by the mere fact that the homeowners are not completely aware of what insurance is all about.

This guide will detail how wind storm roof damage is caused, what insurance generally covers, how to make the effective claim and how Property Damage Claims Experts will offer the homeowners the chance to defend the claim and receive the most compensation possible.

How Wind Storms Damage Roofs

Strong winds do not just blow away shingles, it can also blow away your entire roofing structure. Storms that seem not to be catastrophic may still lead to long-term damages that are worsened with time.

1. Wind Storm Roof Damage Fullness.

2. Lifted, missing, or curled shingles.

3. Wind uplifted shingles creased or cracked.

4. Broken vents, skylights, and chimneys flashing.

5. Loose or detached gutters and downspouts.

6. Rooftop holes of flying debris.

7. Intrusion of water causing leaks, mold or interior damage.

Wind damage is not always apparent. This is why when you are filing your wind storm roof damage insurance claim, you need professional inspections.

Does Homeowners Insurance Cover Wind Storm Roof Damage?

Wind-related roof damage is included in the normal homeowner insurance policy in the majority of situations. The coverage is determined by a number of factors which include:

1.The specific cause of damage

2.Policy exclusions or limitations.

3.Roof age and material

4.Whether your policy is replacement or actual cash value.

5.Your deductible (standard or wind/hurricane deductible)

Insurance companies can attempt to designate damage as wear and tear or poor maintenance in order to escape payment. The Property Damage Claims Experts checks the insurance policies to the letter in order to make sure that the homeowners retrieve all the benefits which they deserve.

When Should You File a Wind Storm Roof Damage Insurance Claim?

You can claim an amount in case:

1.There was a wind storm or extremely bad weather the other day.

2.Shingles are absent, raised, or destroyed.

3.You see water leaks, water spots or discoloration of the ceiling.

4.Storm repair of the roofs is being done by neighbors.

5.An expert examination validates wind-related problems.

The policies in insurance usually demand immediate reporting. Delay to claim your wind storm roof damage insurance claim may lead to a delay or rejection.

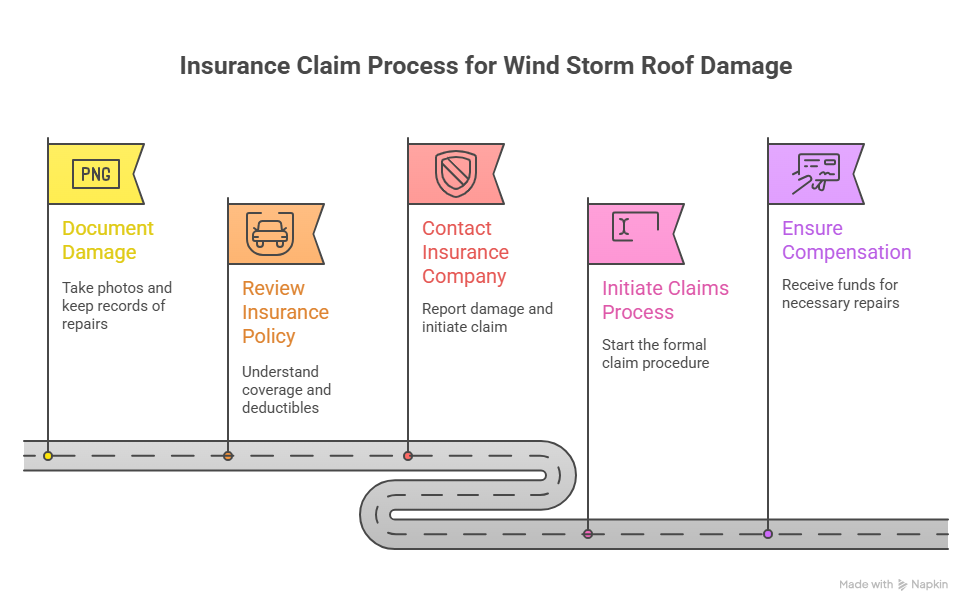

Step-by-Step Guide to Filing a Wind Storm Roof Damage Insurance Claim

1. Inspect Your Roof Safely

Once the storm has ended, check your roof up on the ground. Search the area over and look for shingles, rubbish or damage. Do not climb to the roof with your own hands it can be hazardous.

2. Document All Damage

Make sharp photographs and videos of:

a.Roof damage

b.Interior water damage

c.Fallen debris

d.Damage to gutters, fencing or siding.

Good documentation is also among the greatest components of a successful wind storm roof damage insurance claim.

3. Prevent Further Damage

Homeowners are supposed to reduce extra damages in most insurance policies. Tarping up your home to prevent the leaks and enhance your claim can be considered as one of the temporary repairs.

4. Get in touch with Your Insurance Company.

Inform your insurer immediately. Ask to be assigned a claim number and document all communication such as emails, phone calls, and letters.

5. Get a professional check-up.

Insurance adjusters tend to overlook or underestimate damage. Property Damage Claims Experts offers autonomy of inspection to detect the entire wind-caused damage of the roof and have it documented accordingly.

Why Wind Storm Roof Damage Insurance Claims Are Often Underpaid

Wind damage claims are among the most disputed in the insurance industry. Common reasons insurers underpay or deny claims include:

- Claiming damage existed before the storm

- Arguing the roof failed due to age or poor maintenance

- Overlooking subtle wind uplift damage

- Using outdated pricing for repairs

- Ignoring interior or structural damage

Insurance adjusters work for the insurance company—not the homeowner. Having Property Damage Claims Experts on your side helps level the playing field.

Wind Damage vs. Wear and Tear: Understanding the Difference

One of the reasons insurance companies often make is that the damage on the roof is caused by normal aging and not wind. Nevertheless, wind storms may hasten the process of decaying or reveal some defects or weaknesses that were not evident before.

Examples include:

a.Shingles blown away by the wind That crack days later.

b.Flashing in the storm, which leads to delayed leakage.

c.Damage caused by rain which is driven by wind to the inside.

Causation is important to prove. In-depth checks and records can be used to confirm that the damage is caused by a wind incident, as opposed to a typical wear and tear.

What Insurance Adjusters Look For During Inspections

In a roof damage insurance claim that is caused by a wind storm, the adjusters normally consider:

a.Wind direction patterns

b.Lifted or creased shingles

c.Siding, fences or gutters collateral damage.

d.Local weather data

e.Roof age and condition

Due to a lot of misfortunes, most of the adjusters are in a hurry. The Property Damage Claims Experts are confident that they will not leave out anything and challenge false results when it is critical.

How Property Damage Claims Experts Helps Homeowners

PDC is a company that assists homeowners on complicated insurance claims because of wind storms and natural calamities.

Our Services Include:

a.Comprehensive roof and property checkups.

b.Comprehensive records of damages.

c.Insurance policy analysis

d.Claim support and negotiation support.

e.Appeal of rejected or low paid claims.

House holders who use the services of Property Damage Claims Experts are able to get a much better settlement as compared to individuals who settle claims on their own.

How Long Does a Wind Storm Roof Damage Insurance Claim Take?

Although it varies, the majority of claims take the following general course:

a.Claim reporting: 1–3 days

b.Inspection: 1–2 weeks

c.Insurance decision: 2–4 weeks

d.Repairs and payment: 30–90 days

Claimed delays usually come in when claims are disputed. Claim support by professional can assist in ensuring that the process continues to run smoothly.