One of the most frequent and expensive problems homeowners have to deal with is water damage. Whether it is ruptured pipes and leaky roofs, or broken appliances and floods due to storms, water may ruin a home in a short amount of time. It is important to understand homeowners insurance claims for water damage to save time, avoid unnecessary delays, and reduce the risk of claim denial.

This guide explains everything you need to know about the water damage insurance claim process, what is typically covered, the obstacles homeowners commonly encounter, and how Property Damage Claims Experts can assist you in working through the claims process with ease.

Understanding Water Damage in Homes

Water damage may be sudden or gradual. Insurance companies commonly differentiate between various kinds of water damage, and that difference is critical in the acceptance of claims.

Typical sources of water damage include:

- Burst or frozen pipes

- Water leakage from fittings or pipelines

- Storm-related or wear-and-tear roof leaks

- Overflowing bathtubs, sinks, or toilets

- Malfunctions of appliances such as dishwashers or washing machines.

- HVAC system leaks

Quick action is essential when it comes to water damage. Timely mitigation saves your house and your insurance claim.

Does Homeowners Insurance Cover Water Damage?

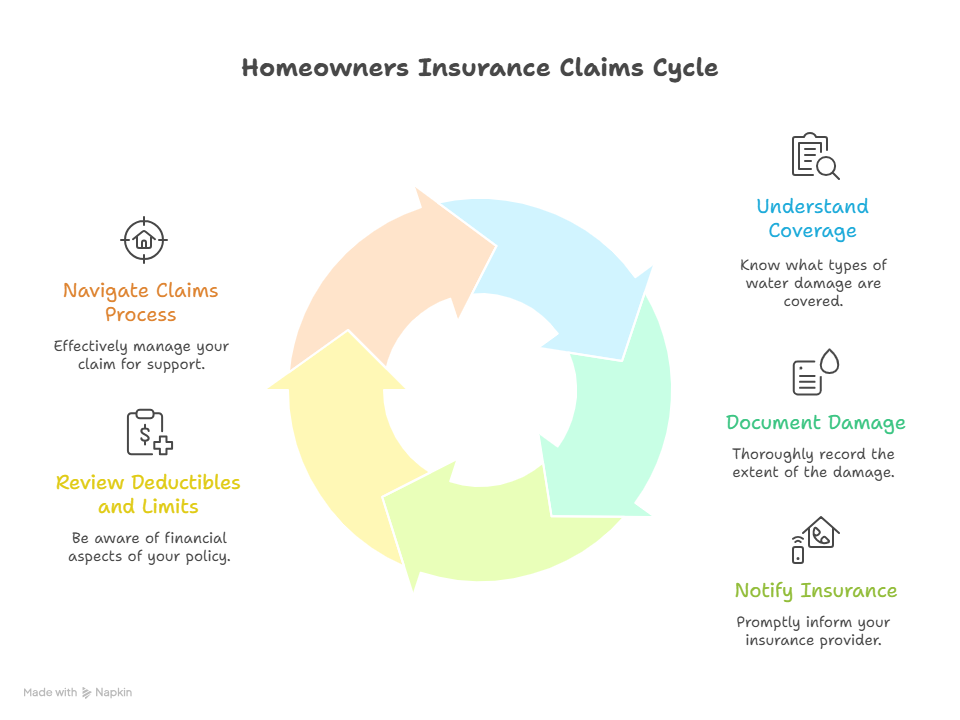

A common question homeowners ask is whether water damage is covered under their policy. The answer depends on the source and nature of the damage.

Typically Covered Water Damage

Homeowners insurance typically includes sudden and accidental water damage such as:

- A pipe that suddenly bursts.

- A water heater failure

- Unintentional spillage of plumbing systems.

- Storm-related roof leaks

In such situations, the damage is considered unforeseen and could be covered by most of the common policies.

Water Damage Often Not Covered

The insurance policies usually exclude:

- Damage caused by rising groundwater.

- Poor maintenance resulting in long term leaks.

- Gradual water seepage

- Damage caused by neglect

This knowledge of these differences is critical when making insurance claims for water damage under a homeowners insurance policy.

The Water Damage Insurance Claims Process

It can be daunting to file a water damage claim, particularly when repairs and temporary displacement are involved. Understanding the process would enable homeowners to remain organised and active.

Step 1: Stop the Source of Water

Once water damage is detected, the first thing to do is to stop the source of the water. Further damage can be avoided by switching off the main supply of water.

Step 2: Document the Damage

A successful claim includes thorough documentation, which is one of the most significant parts of the claim. Make clear shots and videos of:

- Broken walls, floors and ceilings.

- Damaged furniture and other personal property.

- Observable evidence of dampness or mold.

This is documentation that is to be used in the case of your insurance company.

Step 3: Notify Your Insurance Company

It is important to notify your insurance company promptly. The majority of the policies enforce the reporting of water damage as early as possible by the homeowners. Delays can create the issue of neglect.

Step 4: Prevent Further Damage

This is because insurance policies mandate the homeowners to reduce subsequent damage. This can involve the drying of wet spots, placing temporary coverings over roof openings, or standing water.

Step 5: Insurance Inspection

An insurance adjuster will visit your property to examine the extent of the damage and the coverage available. This is a very important step since the report of the adjuster determines the level of settlement.

Common Challenges with Water Damage Claims

Many homeowners find it difficult to file water damage claims under their homeowners insurance policy. Understanding these pitfalls can help you avoid costly errors.

Claim Denials

An insurer may deny a claim if it determines the damage occurred due to:

- Wear and tear

- Lack of maintenance

- Pre-existing issues

Underpaid Settlements

Repairs can also be undervalued or unnoticed, e.g., moisture in the walls or under the floor.

Delays in Processing

The process of water damage claims may be postponed in case of insurance coverage disputes, documentation or back-and-forth communication with insurers.

This is where professional help is of great essence.

The Importance of Professional Claim Support

Handling an insurance claim on your own can be stressful and time-consuming. The policy language, the claim procedures and negotiation strategies employed by the insurers are unknown to many of the homeowners.

Property Damage Claims Experts are experts that specialize in representing homeowners in water damage claims. Their professionalism helps in ensuring that claims are duly recorded, the value is well estimated and the claims settled fairly.

How Property Damage Claims Experts Help Homeowners

Collaborating with Property Damage Claims Experts will offer knowledgeable services to the homeowners in the claims process.

Thorough Damage Assessment

Water damage cannot always be observed. The professionals know how to detect unseen problems like moisture intrusion, mold risks and structural problems that might not be realized by the insurers.

Accurate Claim Valuation

It is important to estimate the actual cost of repair. Underestimates may make the homeowners pay out of pocket. Property Damage Claims Experts make sure that repair costs are based on current market rates and the extent of damages.

Policy Interpretation

Insurance policies are complicated. To ensure that you get the best claim, it is important to know coverage limits, exclusions, and endorsements. Expert interpretation ensures that nothing is overlooked.

Negotiation with Insurers

The insurance companies usually seek to reduce the payouts. The presence of professionals who will be negotiating on your behalf will help to even the playing field and chances of a fair settlement are high.

Preventing Future Water Damage

Insurance provides protection, but there is nothing like prevention. Preventive maintenance helps homeowners reduce the risk of future water damage.

Maintenance Tips

- Periodically check the plumbing.

- Install new pipelines and fittings.

- Clear gutters and guttering.

- Check rooftops for missing or broken shingles.

- Monitor appliances for leaks.

Maintenance ensures your house is well kept and enhances insurance claims in the future by showing that you are a good custodian.

Water Damage and Mold Concerns

Mold growth is one of the worst effects of water damage. Mold may occur within 24 to 48 hours of being exposed to water and may become hazardous when it is not taken care of in time.

Mold coverage depends on the policy. There are also some policies that provide remediation of mold in case it is caused by a covered water damage event. In such cases, it is essential to have proper documentation and professional assessment.

Why Timing Matters in Water Damage Claims

Time is a very important factor in water insurance claims by homeowners. The timeliness of reporting, inadequate documentation, and slow response of mitigation efforts may adversely affect the results of claims.

Timely action and professional advice in the beginning of the process may help avoid disagreements and enhance the outcomes of settlement.

Choosing the Right Support for Your Claim

Not all claims are clear-cut. The complicated cases of water damage that encompass massive repair, structural complications or coverage disputes demand expertise.

Property Damage Claims Experts specialize in safeguarding the interests of the homeowners, being transparent, accurate, and fair in their claims procedure.