Fire outbreaks are devastating, and once the flames are put out, that is not the end of the damage. Smoke and soot may penetrate inside a property and cause significant damage to the walls, ceilings, furniture, and any HVAC system, and even make a home or business structurally unsound. Regrettably, most property owners do not anticipate the effect of smoke damage or do not know how to go through the insurance process in the aftermath. It is important to know how to make fire smoke damage insurance claims effectively to get your place back and be able to get the compensation that you can rightfully claim.

The guide will take you through the whole process step by step to ensure you do not make the mistakes that could happen and make the most of your insurance settlement.

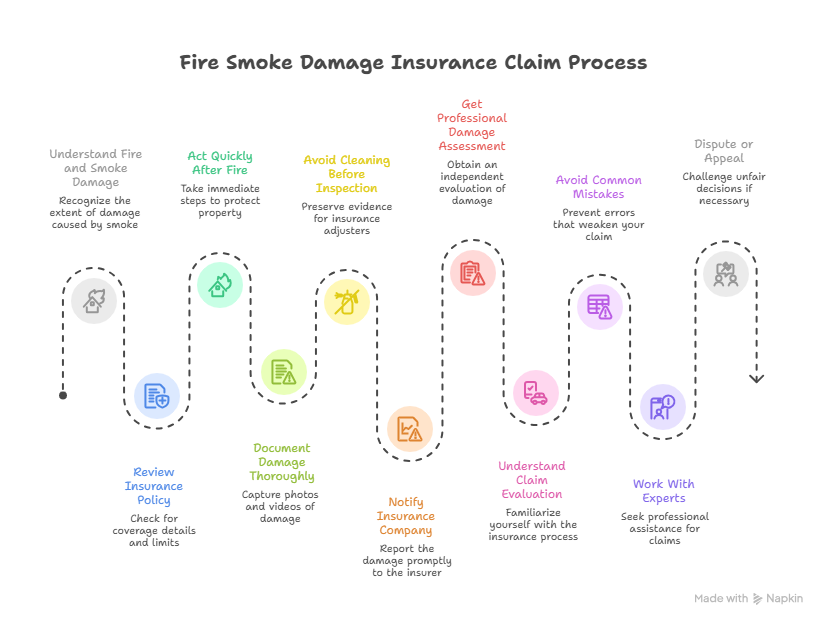

Understanding Fire and Smoke Damage

The flames of fire are not always more extensive than the effects of smoke. Although the flames may have burnt only one room, smoke may spread via ventilation systems, oozing in walls and leaving behind some toxic residue. Smoke damage can include:

- Soot on walls, ceilings, and flooring.

- Constant smell of smoke in materials.

- Destruction of electronics and appliances.

- Corrosion of metal surfaces

- Airborne health risks of the pollutants.

The smoke damage has been acknowledged by insurance companies as part of the losses caused by fire, but this should be well documented. Making fire smoke damage insurance claims without clear knowledge of damage would result in either underpayments or rejection of claims.

Review Your Insurance Policy Carefully

Prior to a claim being filed, check your home ownership or commercial building insurance policy. Look for coverage related to:

- Fire and smoke damage

- Additional living expenses (ALE).

- Personal property loss

- Cleanup and restoration expenses.

Note carefully coverage limits, exclusions, and deductibles. There are policies, which can restrict coverage on smoke damages in cases where they are not well stated. Being aware of what is contained in your policy will assist you in making a more convincing claim when making fire and smoke damage insurance claims.

Act Quickly After the Fire

Time is a very important aspect in insurance claims. Once you have the safety of all people, write now to guard your property against further losses. This may include:

- Boarding up exposed areas

- Sealing areas of damage to avoid weathering.

- Turning off utilities where needed.

Not acting can further harm the smoke, and it is also possible that the insurers will lower your claim. Responsibility comes with acting promptly and working on your fire and smoke damage insurance claims.

Document All Smoke and Fire Damage Thoroughly

The insurance claim is a successful one. Clarify with photos and videos:

- Such smoked walls and ceilings.

- The furniture and other items were covered with soot.

- Broken electronics and appliances.

- Damage of structures due to smoke or heat.

Prepare a comprehensive list of items that have been damaged and give descriptions, approximate value, and date of purchase where possible. The better your records are, the more difficult it is to have your fire and smoke damage insurance claims refuted by the insurers.

Avoid Cleaning Before Inspection

Although it might be tempting to clean smoke residue instantly, it is counterproductive to clean it up before an inspection is performed since this could damage your claim. The insurance adjusters must be able to observe the extent of the damage. Premature cleaning can minimize observable damages and result in a smaller settlement.

Rather, emphasize recording of damage and loss prevention. When the inspection is done, then you may go on with expert cleaning and restoration.

Notify Your Insurance Company Promptly

Report the fire and smoke damage to your insurance company, and do it as soon as possible. Be factual concerning the incident, and do not speculate. Keep to the facts and leave the evaluation of the damage to the professionals.

Recorded statements should be approached with a lot of care when making fire smoke damage insurance claims. Your words can be used to reduce payment by insurers. In case you do not know how to react, you can seek professional help before acting.

Get a Professional Damage Assessment

The insurance companies will tend to depend on their adjusters to figure out the losses. Yet, such measurements might not be able to take into consideration any hidden smoke damage. Smoke may find its way into insulation and ductwork that is not easily noticeable as well as structural elements.

Property Damage Claims Experts can also contribute a lot in this area. Their skilled and seasoned public adjuster will do the independent inspection, discover the hidden damage, and come up with the elaborate reports to take care of your fire smoke damage insurance claims.

Understand the Claim Evaluation Process

After your claim has been compiled, the insurance company will examine the documents, inspect the building, and estimate the payout. This process may involve:

- Adjuster inspections

- Demands for further documentation.

- Settlement negotiations

Underestimating smoke damages or omitting losses is a norm among insurers. This is because being informed and being proactive will assist you in questioning unfair judgments, and also it will enhance you during negotiations.

Avoid Common Mistakes That Hurt Claims

Several mistakes by policyholders include avoidable errors that weaken their Fire Smoke Damage Insurance Claims, including:

- Accepting the settlement offer without a discussion.

- Failure to meet deadlines of documentation or appeals.

- Omission of untold damage or long-term damage.

- Relying on the estimate of the insurer without checking it.

The insurance companies strive to circumvent expenses. Professional representation means that you will be represented in the best way and your claim will contain the actual damage amount.

Work With Property Damage Claims Experts

Insurance claims are not easy to navigate following fire and smoke damage, and it is particularly not easy to do this at a very stressful time. The Property Damage Claims Experts are experts who specialize in dealing with fire and smoke damage insurance claims, and they represent property owners—not insurance companies.

Their services include:

- Extensive destruction surveys.

- Accurate loss valuation

- Documentation and filing of claims.

- Insurance carrier negotiation.

They also utilize industry knowledge in ensuring that the policyholders receive equitable settlements and unnecessary delays are avoided.

Know When to Dispute or Appeal

You can challenge the decision in case your claim is rejected or when it is paid less than it should be. Look through the denial letter thoroughly and outline some of the reasons that have been mentioned by the insurer. In many cases, rejections will be caused by lack of documentation or misunderstanding of the policy wording.

With the professional services of Property Damage Claims Experts, one is able to file supplemental claims, present extra evidence, and appeal against unfair decisions regarding Fire Smoke Damage Insurance Claims.