The intensity and frequency of storms are also increasing in most areas of the United States. Powerful winds, heavy rains, hail, lightning, and falling debris may lead to a lot of destruction of residential and commercial buildings. Although insurance is meant to aid in covering such losses, submitting a claim of storm damage may be hectic, time-consuming, and costly, particularly when the losses may have been avoided.

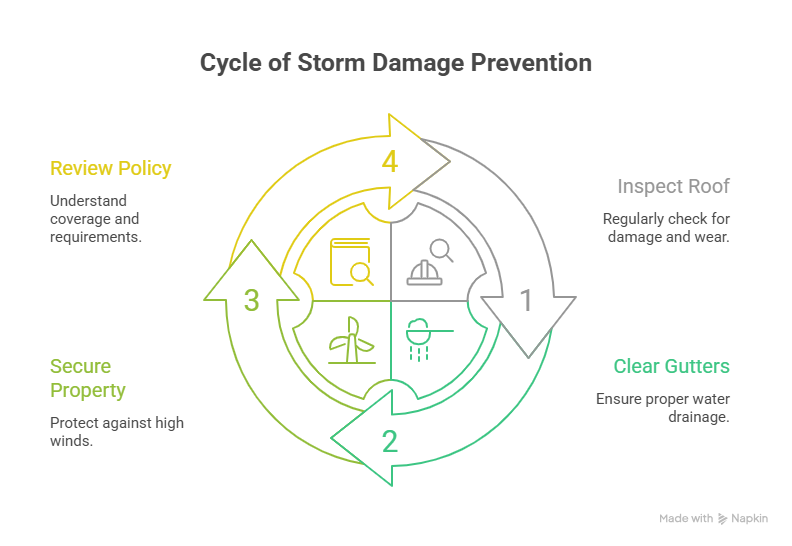

One of the best ways to avoid making unforeseen expenses on repairing your property and having to face complex insurance claims is to learn how to protect your property before a storm strikes. Here, we provide 4 tips on how to avoid the expensive storm damage insurance claims and details given by property damage claims experts.

Why Storm Damage Insurance Claims Can Become Expensive

Most property owners believe that all the damage related to storms is to be covered by insurance automatically. Nevertheless, claims may prove to be expensive because of:

- High deductibles

- The cause of damage disputes.

- Delays in claim processing

- Denials of part coverage or claims.

- Detrimental damage was found out too late.

The property owners are usually supposed to take reasonable preventive measures by the insurance companies. You might not be paid as much or not at all by failing to maintain your property. Preventative action will protect your property besides consolidating your position in case you need to make a claim.

Tip 1: Inspect and Maintain Your Roof Regularly

The part of your property that is most exposed during a storm is your roof. Even minor weak points can be used up by the strong winds, heavy rains, and hail and become serious structural problems.

The importance of roof maintenance.

Loose shingles, cracked tiles, broken flashing, or aging roofing materials may easily fail in harsh weather. As soon as water enters the building, it may harm the insulation, ceilings, walls, and electrical systems, drastically raising the cost of repair.

What You Should Do

- Have the roof inspected at least once every year.

- Install lost or broken shingles immediately.

- Flash checking of chimneys, vents, and skylights.

- Make sure that roof materials used are appropriate in your area.

Regular maintenance will minimize the chances of leakage and will go a long way in showing that you are a responsible owner of the property in case you are in need of an insurance claim sometime in the future.

Property Damage Claims Experts are often involved in claims in which the neglect of the roof makes the whole process complicated. These situations can be prevented by taking proactive care.

Tip 2: Keep Gutters and Drainage Systems Clear

Obstructed gutters and inadequate drainage are typical reasons for property damage caused by the storm. This water, which cannot run off your building, usually gets into your building.

The Cause of Ford Water Damaging Claims.

Clogged gutters may overflow during a heavy rain, and this can lead to the seepage of water in the walls, foundations, and basements. As it ages, it may lead to mold growth, rotting of wood, and weakening of the structures, which are very expensive to fix and not always covered.

Elaborate measures are to be undertaken.

- Clean downspouts and gutters at least 3 times per year.

- Pre-storm drainage systems.

- Make sure downspouts do not lead to foundations.

- Test ground grading to avoid pooling of water.

With such control of water flow, you will greatly ensure that water destruction caused by storms is minimized and insurance claims are not necessary.

Tip 3: Secure Your Property Against High Winds

One of the most disastrous storm components is high winds. Small pieces of debris, branches, and unsecured things that are kept outside can cause so much damage within a few minutes.

Common Wind-Related Damage

- Broken windows and doors

- Fence and shed collapse

- Siding and roof uplift damages.

- Injuries caused by falling trees or branches.

The claims by insurance companies regarding the damage caused by wind are usually the ones concerning responsibility and avoidance, hence are more complex and time-consuming.

Risk of Wind Damage Prevention.

- Cut down trees and prune dead or weak branches.

- Fix outdoor furniture, grills, and equipment.

- Strengthen gates, sheds, and fences.

- Install storm- or impact-resistant windows where necessary.

These preventive measures can go a long way in mitigating the storm damage besides enhancing the general safety of your property.

Property Damage Claims Experts usually recommend to clients to claim their wind damage after taking reasonable precautions ahead of time, and it will be easier to resolve.

Tip 4: Review Your Insurance Policy and Coverage Regularly

A lot of expensive storm damage insurance claims are the result of lack of understanding of the coverage. When taking the assumption that you are completely covered without checking your policy, you are likely to have some ugly surprises in the process when you need it the most.

Why Policy Reviews Matter

The insurance policies differ greatly in coverage, particularly concerning any storm-related incidences like floods, windstorms, and hail. Certain losses might need more endorsements or disjointed policies.

What to Check in Your Policy

The limits of storm and wind coverage.

- Flood damage exclusions

- Storm claims deductibles.

- Maintenance and documentation requirements.

- Claim reporting timelines

It is always a good idea to review your policy once every year and make sure that the coverage corresponds to the current status of your property and the habits of risks around it.

You can have property damage claims experts assist you in deciphering policy language and securing your rights in case you are not certain about what a particular policy covers, or you are having difficulties under a claim.

The Hidden Cost of Delayed Action After a Storm

Storm damage may still take place even when preventative measures are in place. Postponing the inspection or repair of properties after a storm is one of the greatest faults that property owners commit.

Why Instant Action Is The Only Solution.

There are insurance companies that will insist on immediate reporting and showing that you have taken some measures to mitigate additional damage. Delays can lead to:

- Claim denials

- Reduced settlement amounts

- Other damage that was discovered.

- Structural issues in the long term.

Following a storm, it is essential to write down observed damage, get some temporary services in case of damages, and get professional advice.

How Property Damage Claims Experts Can Help

Prevention is important, but all the storm damage cannot be avoided. The professional assistance may be invaluable, particularly when you have to make a claim.

The Property Damage Claims Experts are professionals who assist homeowners and business owners to handle tricky insurance claims. Their expertise includes:

- Examining storm damage correctly.

- Determining latent or secondary damage.

- Securing claims is in line with the extent of loss.

- Handling your insurance companies.

- Making the most out of fair settlements.

The property owners would also minimize the stress that comes with insurance claims on storm damages with professional counseling.

Long-Term Benefits of Storm Preparedness

Evading expensive coverage of storm damage claims does not only mean saving money in the immediate future. Preventative measures are long-term in that they provide:

- Longer life span of property.

- Lower maintenance costs

- Better protection of occupants.

- Higher property value

- Fewer disruptions following extreme weather.

Preparedness is the one way to save money and secure your finances and calm in the future.